Quarterly Financial Report for period ending June 30, 2016

Statement outlining results, risks and significant changes in operations, personnel and program

1. Introduction

1.1 Background to the Quarterly Report

As per the Treasury Board Accounting Standard (TBAS) 1.3, the Office of the Communications Security Establishment Commissioner (Office) is submitting its quarterly report.

This section of the quarterly financial report should be read in conjunction with the Main Estimates (and as applicable - Supplementary Estimates and previous interim reports for the current year). The report has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board. This quarterly financial report has not been subject to external audit or review.

1.2 Authority, Mandate and Program

The position of Communications Security Establishment Commissioner was created to review the activities of Communications Security Establishment (CSE) to determine whether it performs its duties and functions in accordance with the laws of Canada. This includes having due regard for the privacy of Canadians.

The Commissioner derives his authority and mandate from the National Defence Act:

- reviewing CSE activities to ensure they comply with the law;

- conducting any investigations deemed necessary in response to complaints about the CSE;

- reviewing and reporting annually to the Minister on review activities carried out under an (ministerial) authorization

- informing the Minister of National Defence and the Attorney General of Canada of any CSE activities that may not be in compliance with the law; and

- submitting to the Minister for tabling in Parliament, within 90 days after the end of each fiscal year, an annual report on the Commissioner's activities and findings.

In addition the Commissioner also has a mandate under the Security of Information Act to receive information from persons who are permanently bound to secrecy seeking to release special operational information on the grounds that it is in the public interest.

Further information on the mandate, roles, responsibilities and programs of the Office can be found in the Office's 2016–2017 Report on Plans and Priorities and in the

Main Estimates.

1.3 Basis of Presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes the Office's spending authorities granted by Parliament and those used by the Office consistent with the Main Estimates and Supplementary Estimates (as applicable) for the 2016–2017 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework, designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before moneys can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

When Parliament is dissolved for the purposes of a general election, section 30 of the Financial Administration Act authorizes the Governor General, under certain conditions, to issue a special warrant authorizing the Government to withdraw funds from the Consolidated Revenue Fund. A special warrant is deemed to be an appropriation for the fiscal year in which it is issued.

The Office uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental performance reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

2. Highlights of fiscal quarter and fiscal year to date (YTD) results

First Quarter/ Year to Date

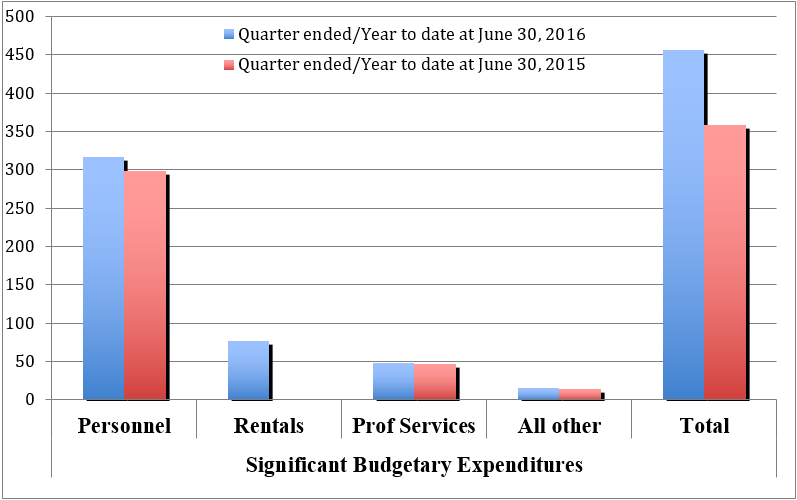

As reflected in the attached Statement of Authorities and in Table 1 Departmental budgetary expenditures by Standard Object (below) and illustrated in the chart (above), the Office's first quarter/year to date spending in 2016–2017 is up $97 thousand from the same quarter/year to date of the previous year.

This change can be attributed to the following factors:

- an increase of $76 thousand for rent — delays in Public Works and Government Services Canada billings for rent in 2015–2016;

- an increase of $19 thousand for salaries and benefits is due primarily to the hiring of two employees at the start of the fiscal year; and

- a slight increase in other costs of $2 thousand.

3. Risks and Uncertainties

Transparency

To the greatest extent possible within the confines of the Security of Information Act my office must continue to provide information and explanation on the activities of CSE in order that Canadians can feel confident that the activities of CSE are being rigorously reviewed and that their privacy is being protected.

4. Significant changes in relation to operations, personnel and programs

The office filled two full-time review officer positions at the start of 2016-17. There were no significant changes in relation to operations and programs.

5. Approval by Senior Officials

Original signed by:

The Honorable Jean-Pierre Plouffe, C.D.

Commissioner

J. William Galbraith

Chief Financial Officer

Ottawa, Canada

July 26, 2016

Statement of Authorities (unaudited)

| Total available for use for the year ending March 31, 2017 | Used during the quarter ended June 30, 2016 | Year to date used at quarter-end | |

|---|---|---|---|

| Vote 1 - Program Expenses | 1,940 | 410 | 410 |

| Statutory authorities – Contributions to employee benefit plans | 185 | 46 | 46 |

| Total Budgetary authorities | 2,125 | 456 | 456 |

| Total authorities | 2,125 | 456 | 456 |

| Total available for use for the year ended March 31, 2016 | Used during the quarter ended June 30, 2015 | Year to date used at quarter-end | |

|---|---|---|---|

| Vote 1 - Program Expenses | 1,850 | 314 | 314 |

| Statutory authorities – Contributions to employee benefit plans | 181 | 45 | 45 |

| Total Budgetary authorities | 2,031 | 359 | 359 |

| Total authorities | 2,031 | 359 | 359 |

Table 1: Departmental Budgetary Expenditures by Standard Object (unaudited)

| Expenditures | Planned expenditures for the year ending March 31, 2017 | Expended during the quarter ended June 30, 2016 | Year to date used at quarter-end |

|---|---|---|---|

| Personnel | 1,263 | 317 | 317 |

| Transportation and communications | 35 | 6 | 6 |

| Information | 25 | 4 | 4 |

| Professional and special services | 449 | 48 | 48 |

| Rentals | 315 | 76 | 76 |

| Repair and maintenance | 3 | 0 | 0 |

| Utilities, materials and supplies | 20 | 5 | 5 |

| Acquisition of land, buildings and works | 0 | 0 | 0 |

| Acquisition of machinery and equipment | 15 | 0 | 0 |

| Other subsidies and payments | 0 | 0 | 0 |

| Total gross budgetary expenditures | 2,125 | 456 | 456 |

| Total net budgetary expenditures | 2,125 | 456 | 456 |

| Expenditures | Planned expenditures for the year ending March 31, 2016 | Expended during the quarter ended June 30, 2015 | Year to date used at quarter-end |

|---|---|---|---|

| Personnel | 1,258 | 298 | 298 |

| Transportation and communications | 40 | 6 | 6 |

| Information | 17 | 5 | 5 |

| Professional and special services | 378 | 47 | 47 |

| Rentals | 310 | 0 | 0 |

| Repair and maintenance | 1 | 0 | 0 |

| Utilities, materials and supplies | 17 | 3 | 3 |

| Acquisition of land, buildings and works | 0 | 0 | 0 |

| Acquisition of machinery and equipment | 10 | 0 | 0 |

| Other subsidies and payments | 0 | 0 | 0 |

| Total gross budgetary expenditures | 2,031 | 359 | 359 |

| Total net budgetary expenditures | 2,031 | 359 | 359 |

- Date modified: